Factor rates are used to calculate the cost of certain business financing products, such as merchant cash advances. Factor rates are written as decimal figures rather than percentages like interest rates. Using factor rates to figure out interest on business financing may seem tricky at first, but it’s a simple calculation.

What is a factor rate?

Factor rates are specific to business funding and are less common than annual percentage rates (APRs), which incorporate the interest rate and fees. Factor rates, sometimes called buy rates, are typically between 1.1 and 1.5. The rate depends on your:

- Small business’s industry

- Length of time in business

- Sales stability

- Average monthly credit card sales

Factor rates are generally associated with high-risk lending products, such as merchant cash advances or short-term business loans from alternative, nonbank business lenders. These funding options typically have fast repayment terms and high rates on relatively small amounts, but lenient eligibility requirements.

Merchant cash advances, or MCAs, most commonly use factor rates over APRs. It’s important to note that MCAs aren’t loans. Rather, they’re an advance of money in exchange for a percentage of your future credit or debit card sales. MCA amounts typically range from $5,000 to $500,000, though you could receive as much as $1 million.

An MCA company provides funds that you pay back daily based on the sales you make. Since your repayment is based on a percentage of your sales, the amount you pay back increases and decreases depending on your daily sales.

How to calculate a factor rate

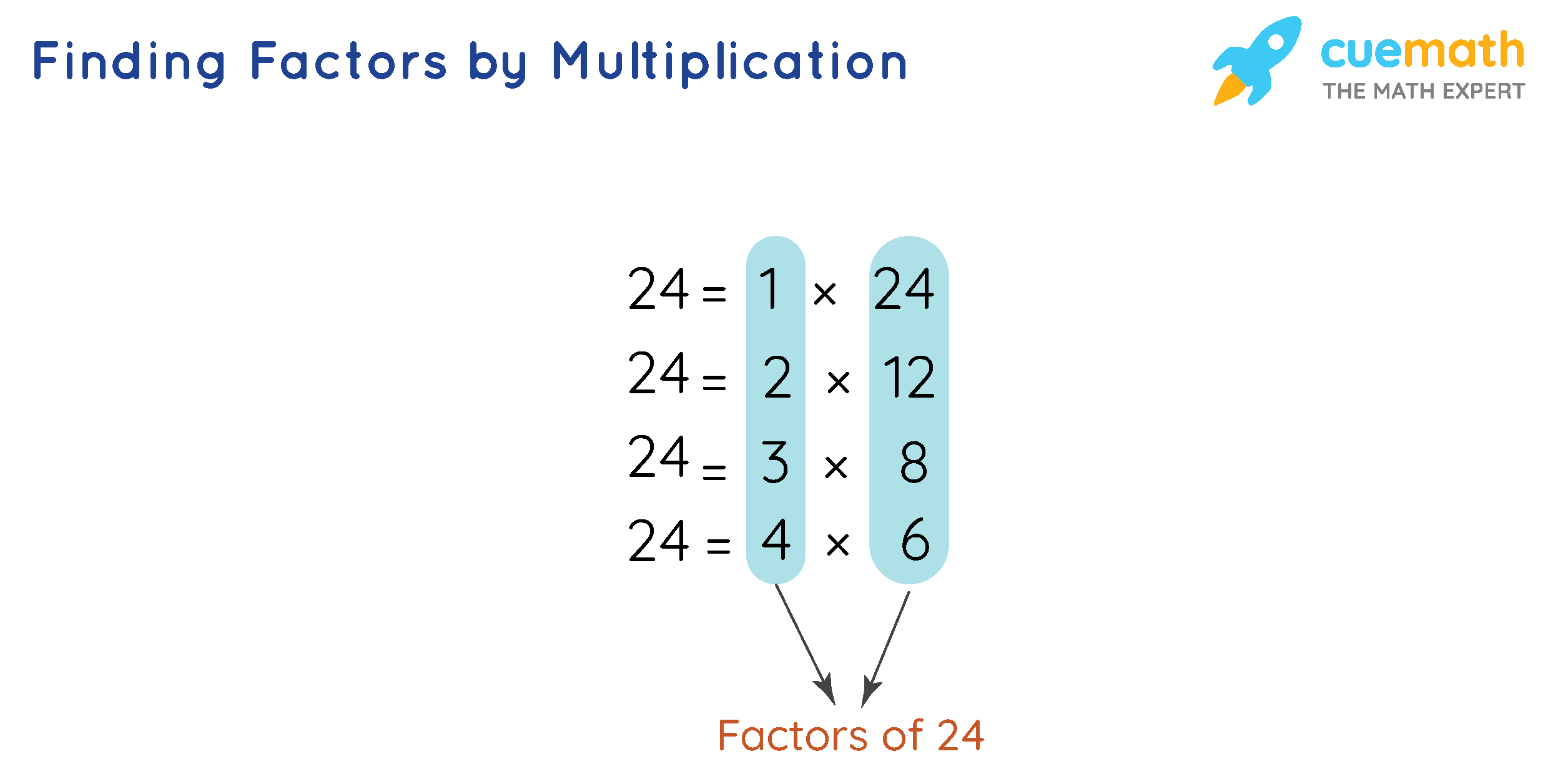

To determine how much you would pay for financing, you would multiply your financing amount by the factor rate. The total would be the amount that you’d pay back to the lender.

Say you get a $10,000 MCA with a 1.25 factor rate. To figure out how much you’ll pay back to the MCA provider, multiply the cash advance amount by the factor rate.

In this instance, the calculation would be:

You would pay back $12,500 total to the MCA provider for borrowing $10,000. That means the cost of the advance is $2,500.

That may seem steep for the principal amount, but MCAs are among the most expensive funding products available. They’re a big risk to the MCA provider because, unlike a loan, there’s no personal guarantee and no obligation to repay the advance amount. That’s one of the main reasons why MCAs tend to cost so much more.

How to Calculate Present value factor, factoring and constant on calculator Easy way

FAQ

What is the formula for the price factor?

What is an example of a factor price?

What do you mean by pricing factor?

What is the factor pricing method?

How do I calculate the net price factor?

Using our Net Price Factor Calculator is a breeze. Follow these simple steps: Enter the Discount Rate (%): This is the percentage by which the price is reduced. Enter the Tax Rate (%): This is the percentage of tax applied to the discounted price. Click the “Calculate” button to instantly obtain the Net Price Factor. NPF is the Net Price Factor.

What is the net price factor?

T is the Tax Rate in percentage. Let’s say you have a product with a 20% discount and a 10% tax rate. Plugging these values into the formula: So, the Net Price Factor is 0.88. 1. Why is the Net Price Factor important?

How do you calculate GDP at factor cost?

This value calculated here is inclusive of depreciation as well. GDP at Factor Cost = Sum of all GVA at factor cost. GDP at Market Price = GDP at factor cost + Product taxes + Production tax – Product subsidies – Production subsidies.

How to calculate net price?

(Select all that apply.) The Net Price is also calculated by using the Complement Method for Trade Discount. It the defined as 100 % minus the discount rate to calculate the Net Price Rate and then multiply it with the List Price to find the Final Net Price of the item: