When restaurant staff receives tips, both employee and employer incur legal obligations to the IRS to correctly record the tip amounts, comply with reporting requirements, and pay income and payroll taxes. For the restaurant operator, it’s critical to get these details correct from the start to avoid unnecessary penalties. This article will cover how to record tips in accounting and what the tax responsibilities look like from the employer and employee sides.

The journal entry to recognize tips is to credit a revenue account and debit cash. This entry is usually done every day or week for the cumulative tip amount and not one by one. An account receivable is not normally set up for tips because most businesses know about tip amounts after they are received.

What are Employer Tip Responsibilities?

The first duty that falls on employers is to record the amount of tips employees receive. This is achieved by collecting regular (at minimum, monthly) reports from all your tipped employees. These reports must contain daily records of tips received, whether in cash, by card, or as distributions of tip pooling. Some wonder how to report credit card tips, specifically. The answer is the same as reporting cash tips — only the daily and monthly tip totals are important.

The employee tip report does not include automatic gratuities, such as those applied to large parties, as those are compulsory payments and do not meet the legal standard to be considered a tip. Auto-gratuities are instead categorized as part of the employee’s regular wages (with all the typical payroll tax withholdings).

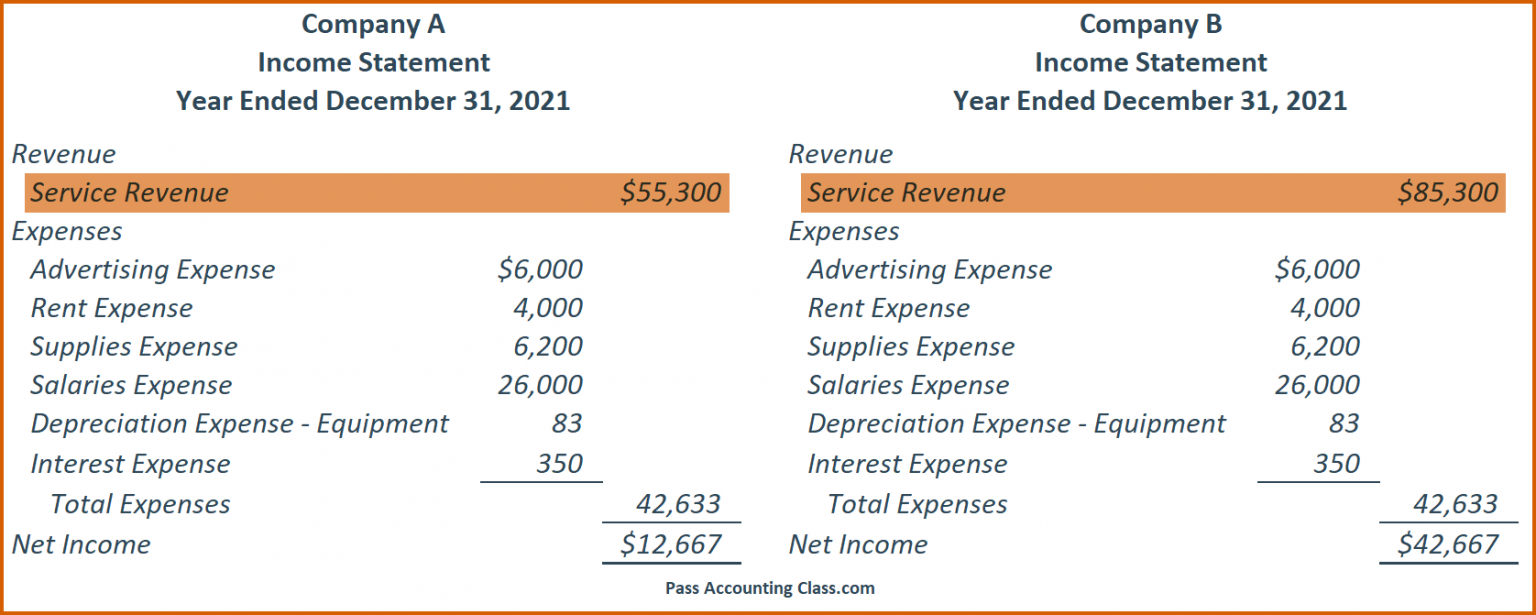

Accounting for tip income

The second employer tip responsibility is withholding income tax, Social Security, and Medicare tax on tip income. Taxes are to be deposited with the IRS every quarter via Form 941. If employees fail to report tip income, the employer is not liable for taxes on the unreported tips until they receive a notice and demand from the IRS.

In other words, “are employee tips payable to the IRS?” Tip taxes are payable only when the employer is appropriately notified of the tips by the employee. Accounting for tips in your restaurant payroll is can be complicated but a modern restaurant accounting solution will assist in streamlining the process.

“Large food or beverage establishments” are employers who, on average, have more than 10 employees working on any given day. These businesses are required to file IRS Form 8027. This form records receipts from food and beverage sales and tips reported to the employer. Note that this reporting requirement applies per location, so quick-service restaurants and other multi-location brands will need to file an 8027 for each restaurant that meets the headcount requirement.

The IRS stipulates for qualifying large employers that tips to employees must be equal to or greater than 8% of gross receipts. If reported tips are below that amount, the employer must distribute them to tipped employees until that measure is reached.

As mentioned above, employees must keep a record of daily tips and submit that record to their employers monthly or more frequently if requested.

Employees are responsible for reporting tips to IRS as income and paying their share of income tax, Social Security tax, and Medicare tax via Form 1040. Note that, as previously stated, auto-gratuities such as those applied to large parties are not tips and should be treated like regular income. When making their annual tax payments, employees may find they have unreported tip income for which to account.

WATCH THE FULL VIDEO HERE!

How to Record Tips in Accounting

FAQ

How should tips be recorded in accounting?

Are tips recorded as revenue?

How does the IRS treat tips?

How do you record a tip?

How to handle tips properly in accounting?

Handling tips properly in accounting can be tricky because these transactions are usually in cash, and it is easy to forget about them at the end of a busy day. But there are ways to capture the transactions and to recognize them in the accounting books. 1. Deposit all money received in the bank daily, including tips.

How do you keep cash tips accurate?

Also, regularly deposit cash tips into your bank account. To maintain accuracy, be sure to update your tip records regularly. Try calculating at the end of each working day and checking over these numbers at the end of the week. Depending how often you get tipped, you may want to record them individually or as a daily sum.

How do I separate tips from regular income?

2. Set up accounts. Create separate accounts for tips, such as a Revenue-Tips account, which reports in the profit and loss statement as income, separate from your regular revenue. Depending on your business, you could also recognize tips together with regular income in one account and not separate them.

Are tips taxable?

All cash and non-cash tips an received by an employee are income and are subject to Federal income taxes. All cash tips received by an employee in any calendar month are subject to social security and Medicare taxes and must be reported to the employer.